Tax Deducted at Source (TDS) is a mechanism introduced by the Indian government to collect taxes at the source of income generation. It ensures that the government receives tax revenue in a timely manner and also helps in preventing tax evasion. One such provision is under Section 194H of the Income Tax Act, which deals specifically with TDS on commission or brokerage payments. This article aims to delve into the provisions of Section 194H, its applicability, exemptions, rates, and compliance requirements.

Section 194H: Overview and Applicability

Section 194H of the Income Tax Act, 1961 deals with the deduction of TDS on commission or brokerage payments. It mandates that any person responsible for paying commission or brokerage exceeding a specified threshold to a resident individual or a Hindu Undivided Family (HUF) is required to deduct TDS at the prescribed rates.

Key Points:

- Applicability: This section applies to any person making payment of commission or brokerage to a resident individual or a Hindu Undivided Family (HUF).

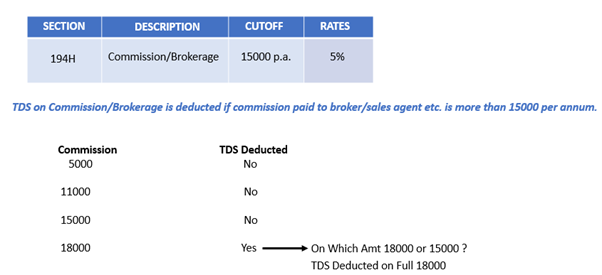

- Threshold Limit: TDS under Section 194H is applicable if the aggregate commission or brokerage payment exceeds Rs. 15,000 in a financial year.

Rates of TDS Under Section 194H

The rates of TDS under Section 194H are specified by the Income Tax Act and are subject to change as per amendments made from time to time. As of the latest available information, the applicable TDS rate under Section 194H is 5%.

Note: It is imperative to verify the current TDS rates applicable at the time of making payments as per the prevailing tax laws.

Exemptions and Exceptions

While Section 194H mandates TDS on commission or brokerage payments, there are certain exemptions and exceptions provided under the Income Tax Act:

- Threshold Limit: TDS is applicable only if the aggregate commission or brokerage payment exceeds Rs. 15,000 in a financial year. Payments below this threshold are exempted from TDS deduction.

- Non-applicability to Individuals and HUFs: Section 194H applies only to payments made to resident individuals or Hindu Undivided Families. Payments made to other entities such as companies, firms, or non-residents are not covered under this section.

- Insurance Commission: Commission payments made by an insurance company to its agents or intermediaries are covered under a separate provision, i.e., Section 194D. Hence, such payments are not subject to TDS under Section 194H.

Compliance Requirements

Compliance with TDS provisions is crucial to avoid penalties and legal consequences. Here are the key compliance requirements under Section 194H:

- Obtaining PAN: The person responsible for deducting TDS must obtain and verify the Permanent Account Number (PAN) of the payee. TDS is to be deducted at the prescribed rates if PAN is provided. In case the payee does not have a PAN, TDS must be deducted at a higher rate as per the Income Tax Act.

- TDS Deduction and Payment: TDS must be deducted at the time of credit of commission or brokerage to the payee’s account or at the time of payment, whichever is earlier. The deducted TDS must be paid to the government within the specified due dates.

- TDS Return Filing: The person deducting TDS is required to file quarterly TDS returns providing details of TDS deducted and deposited. Failure to file TDS returns within the stipulated time attracts penalties under the Income Tax Act.

- Issuance of TDS Certificates: Form 16A is to be issued to the payee providing details of TDS deducted and deposited. It serves as proof of TDS deduction and facilitates the payee in claiming credit for the same while filing income tax returns.

Conclusion

Section 194H of the Income Tax Act, 1961, lays down provisions for the deduction of TDS on commission or brokerage payments. It aims to ensure tax compliance and timely collection of taxes. Understanding the provisions, rates, exemptions, and compliance requirements under this section is essential for both payers and payees to avoid legal implications and ensure smooth business operations.

It is advisable to seek professional advice or refer to the latest amendments and notifications issued by the Income Tax Department for accurate interpretation and compliance with the provisions of Section 194H. Compliance with TDS provisions not only fulfils legal obligations but also contributes to building a transparent and accountable tax ecosystem.

Adv. khanak Sharma

Always providing clarity and peace of mind.

can i get cheap lisinopril pill

I trust them with all my medication needs.

The team always keeps patient safety at the forefront.

order lisinopril without insurance

Clean, well-organized, and easy to navigate.

Global expertise that’s palpable with every service.

where buy generic cytotec without prescription

Their global presence ensures prompt medication deliveries.