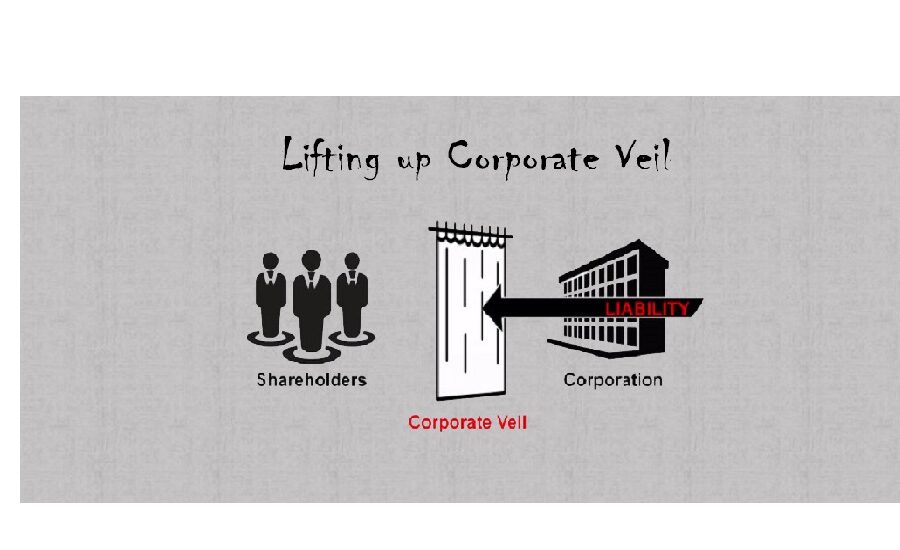

The concept of a company being a separate legal entity from its member is a fundamental principle of a corporate law , this principle known as “Corporate Veil “ , has been a cornerstone of commercial transaction, allowing businesses to operate with limited liability &shielding shareholders from personal liability for the companies actions. However in certain exceptional circumstances, court may disregard this veil & hold shareholders or members personally liable for the company’s obligations. This process is commonly referred to as “Lifting or Piercing of Corporate Veil.”

In India, the doctrine of lifting the corporate veil is well established & has been recognized by the by the courts through various landmark judgement. The primary legal framework governing this doctrine is found in The Companies Act, 2013 and its predecessor The Companies Act, 1956.

One of the most renowned cases in India that dealt with the concept of the lifting up o the corporate veil is Life Insurance Corporation of India Versus Escorts Ltd.& Ors. (1986).

In this case, the Supreme Court held that the corporate veil can be lifted when the corporate formed, is misused for tax evasion, circumventing legal obligation, or perpetrating fraud. The court emphasized that the corporate veil should be disregarded when it is used as a cloak for fraud or improper conduct.

Another significant case is Delhi Development authority v. Skipper Construction Company (P) Ltd. & Anr.(1996) where the Supreme Court reiterated the principle that the corporate veil can be lifted in tax evasion, circumventing legal obligations, or perpetrating fraud. The court also stated that the corporate veil could be pieced when it is used to facilitate the evasion of welfare law or to defeat public convenience.

The Companies Act, 2013 has codified certain provision relating to lifting the corporate veil; Section 7(7) of the act allows the central government to disregard the separate legal entity of a company if it is necessary to do so in the public interest. Additionally, Section 339 empowers the National Company Law Tribunal (NCLT) to lift the corporate veil in cases of oppression, mismanagement, or if the company’s affairs are being conducted in a manner prejudicial to public interest.

While the Indian courts and legislature have recognized the need to lift the corporate veil in exceptional circumstances, the application of this doctrine is not uniform across jurisdictions. In the United Kingdom, the doctrine of lifting the corporate veil has been more restrictively applied. The landmark case of Salomon v. Salomon & Co. Ltd. (1897) established the principle of separate legal personality of a company, and subsequent cases have generally upheld this principle, except in cases of fraud or improper conduct.

In contrast, the United States has a more liberal approach to piercing the corporate veil. Courts in the US have developed various tests and factors to determine whether the corporate veil should be pierced, such as the degree of control exercised by the shareholders over the corporation, commingling of assets, and the use of the corporate form for improper purposes

Other countries, such as Australia & Canada, have adopted approaches that are somewhat similar to the U.K, with a reluctance to pierce the corporate veil except in cases of fraud or improper conduct. However, there have been instances where courts in these jurisdictions have been willing to lift the veil in circumstances where upholding the separate legal personality would lead to unjust or inequitable outcomes.

The doctrine of lifting the corporate veil is a complex area of corporate law, with varying approaches and interpretations across different jurisdictions. While India has recognized the need to disregard the separate legal personality of a company in exceptional circumstances, such as fraud, tax evasion, or circumvention of legal obligations, the application of this doctrine remains subject to judicial discretion and interpretation.

As businesses increasingly operate across borders and engage in complex corporate structures, the issue of lifting the corporate veil is likely to gain further prominence. Striking a balance between upholding the principle of separate legal personality and addressing instances of abuse or improper conduct will continue to be a challenge for lawmakers and courts alike.

It is essential for companies and their stakeholders to be aware of the legal framework and judicial precedents surrounding the lifting of the corporate veil, both in their home jurisdiction and in the jurisdictions where they operate. Maintaining transparency, adhering to legal and ethical standards, and avoiding any improper use of the corporate form are crucial to mitigating the risks associated with the potential piercing of the corporate veil.

contributed by :- Devesh Modi

ICFAI law School 2022-25

Their global perspective enriches local patient care.

where can i buy cheap lisinopril without insurance

A global name with a reputation for excellence.

A touchstone of international pharmacy standards.

can i buy generic cytotec no prescription

Read now.

A beacon of reliability and trust.

gabapentin 300mg capsule

Leading the way in global pharmaceutical services.

A pharmacy that takes pride in community service.

tramadol and gabapentin together for dogs

Their multilingual support team is a blessing.

Their health and beauty section is fantastic.

gabapentin sale

World-class service at every touchpoint.