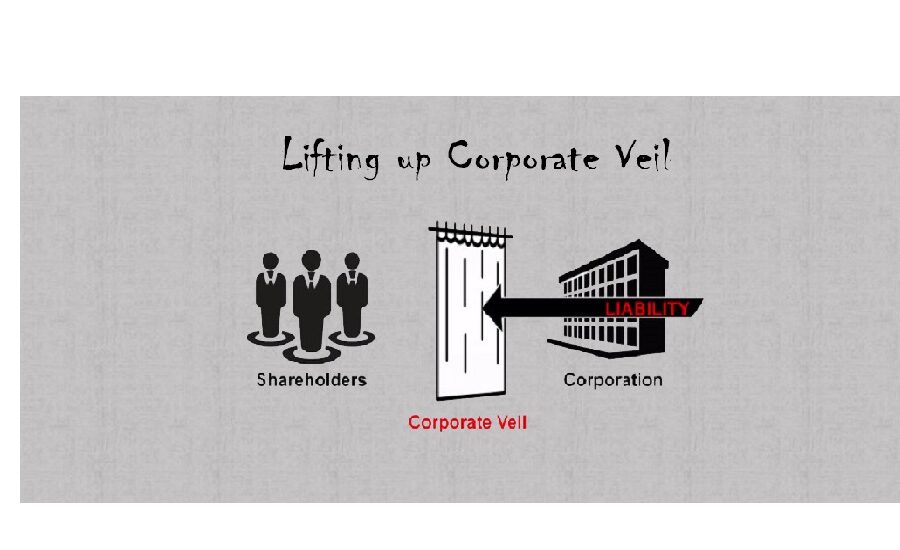

The concept of a company being a separate legal entity from its member is a fundamental principle of a corporate law , this principle known as “Corporate Veil “ , has been a cornerstone of commercial transaction, allowing businesses to operate with limited liability &shielding shareholders from personal liability for the companies actions. However in certain exceptional circumstances, court may disregard this veil & hold shareholders or members personally liable for the company’s obligations. This process is commonly referred to as “Lifting or Piercing of Corporate Veil.”

In India, the doctrine of lifting the corporate veil is well established & has been recognized by the by the courts through various landmark judgement. The primary legal framework governing this doctrine is found in The Companies Act, 2013 and its predecessor The Companies Act, 1956.

One of the most renowned cases in India that dealt with the concept of the lifting up o the corporate veil is Life Insurance Corporation of India Versus Escorts Ltd.& Ors. (1986).

In this case, the Supreme Court held that the corporate veil can be lifted when the corporate formed, is misused for tax evasion, circumventing legal obligation, or perpetrating fraud. The court emphasized that the corporate veil should be disregarded when it is used as a cloak for fraud or improper conduct.

Another significant case is Delhi Development authority v. Skipper Construction Company (P) Ltd. & Anr.(1996) where the Supreme Court reiterated the principle that the corporate veil can be lifted in tax evasion, circumventing legal obligations, or perpetrating fraud. The court also stated that the corporate veil could be pieced when it is used to facilitate the evasion of welfare law or to defeat public convenience.

The Companies Act, 2013 has codified certain provision relating to lifting the corporate veil; Section 7(7) of the act allows the central government to disregard the separate legal entity of a company if it is necessary to do so in the public interest. Additionally, Section 339 empowers the National Company Law Tribunal (NCLT) to lift the corporate veil in cases of oppression, mismanagement, or if the company’s affairs are being conducted in a manner prejudicial to public interest.

While the Indian courts and legislature have recognized the need to lift the corporate veil in exceptional circumstances, the application of this doctrine is not uniform across jurisdictions. In the United Kingdom, the doctrine of lifting the corporate veil has been more restrictively applied. The landmark case of Salomon v. Salomon & Co. Ltd. (1897) established the principle of separate legal personality of a company, and subsequent cases have generally upheld this principle, except in cases of fraud or improper conduct.

In contrast, the United States has a more liberal approach to piercing the corporate veil. Courts in the US have developed various tests and factors to determine whether the corporate veil should be pierced, such as the degree of control exercised by the shareholders over the corporation, commingling of assets, and the use of the corporate form for improper purposes

Other countries, such as Australia & Canada, have adopted approaches that are somewhat similar to the U.K, with a reluctance to pierce the corporate veil except in cases of fraud or improper conduct. However, there have been instances where courts in these jurisdictions have been willing to lift the veil in circumstances where upholding the separate legal personality would lead to unjust or inequitable outcomes.

The doctrine of lifting the corporate veil is a complex area of corporate law, with varying approaches and interpretations across different jurisdictions. While India has recognized the need to disregard the separate legal personality of a company in exceptional circumstances, such as fraud, tax evasion, or circumvention of legal obligations, the application of this doctrine remains subject to judicial discretion and interpretation.

As businesses increasingly operate across borders and engage in complex corporate structures, the issue of lifting the corporate veil is likely to gain further prominence. Striking a balance between upholding the principle of separate legal personality and addressing instances of abuse or improper conduct will continue to be a challenge for lawmakers and courts alike.

It is essential for companies and their stakeholders to be aware of the legal framework and judicial precedents surrounding the lifting of the corporate veil, both in their home jurisdiction and in the jurisdictions where they operate. Maintaining transparency, adhering to legal and ethical standards, and avoiding any improper use of the corporate form are crucial to mitigating the risks associated with the potential piercing of the corporate veil.

contributed by :- Devesh Modi

ICFAI law School 2022-25

Their global perspective enriches local patient care.

where can i buy cheap lisinopril without insurance

A global name with a reputation for excellence.

A touchstone of international pharmacy standards.

can i buy generic cytotec no prescription

Read now.

A beacon of reliability and trust.

gabapentin 300mg capsule

Leading the way in global pharmaceutical services.

A pharmacy that takes pride in community service.

tramadol and gabapentin together for dogs

Their multilingual support team is a blessing.

Their health and beauty section is fantastic.

gabapentin sale

World-class service at every touchpoint.

Hey I know this is off topic but I was wondering if you knew of any widgets I could add to my blog that automatically tweet my newest twitter updates. I’ve been looking for a plug-in like this for quite some time and was hoping maybe you would have some experience with something like this. Please let me know if you run into anything. I truly enjoy reading your blog and I look forward to your new updates.

Zudem gibt es innerhalb des Casino Royals noch

den einen eindrucksvollen Pokerfloor, der sich bis 2018 noch gesondert im Erdgeschoss befand.

Bei den fünf Blackjack-Tische gilt derweil ein Mindesteinsatz von 4 Euro, die obere Grenze

liegt bei 1.000 Euro. Beim Roulette, welches vornehmlich in der amerikanischen Variante zur Verfügung

steht, kann schon ab 2 Euro gezockt werden. Das Große Spiel mit Roulette und Blackjack wird innerhalb

der Spielbank Berlin im Casino Royal betrieben. Dieses gibt es bereits seit 1975

gibt und siedelte nach der Wiedervereinigung 1998

an ihren aktuellen Standort um.

Das Casino befindet sich inzwischen im ehemaligen Weinsaal des Kurhauses, wo die Bedürfnisse eines jeden Gamblers gestillt

werden. Der Weg von der Tiefgarage bis zum Casino ist

kurz und vollständig überdacht. Parkmöglichkeiten hält die Spielbank in der anliegenden und durchgängig geöffneten Kurparkgarage in ausreichender Stückzahl

(528 Stellplätze) bereit. Die Herren sollten zum Klassischen Spiel mindestens

ein Hemd und Sakko tragen, während sich die Damen bei ihrer Kleiderwahl für nicht zu freizügige Garderobe entscheiden sollten. Wie es sich für eine noble Spielbank gehört, gelten bei der Kleiderordnung

etwas strengere Richtlinien (Dresscode Ratgeber – Was

in der Spielbank tragen?). Rauchen ist im Casino Baden-Baden in abgetrennten Bereichen möglich, an Spieltischen herrscht jedoch generelles Rauchverbot.

References:

https://online-spielhallen.de/verde-casino-deutschland-ein-umfassender-uberblick-fur-spieler/

On low risk, larger multipliers sit closer to the

centre so you see more frequent, smaller wins.

You can choose from Plinko boards that match your pace

and risk appetite. If you’d rather skip downloads, licensed

casino sites run Plinko in your mobile browser using HTML5 and responsive layouts.

Plinko casino apps support most modern devices and typically need iOS 12.0 or Android 7.0 or later.

🌈 Visual quality hasn’t been compromised one bit in the Plinko casino mobile

adaptation. This attention to detail creates a seamless

gaming experience that might actually feel more satisfying than the desktop

version! Crank up the risk factor and aim for multipliers that can skyrocket your bankroll in a single lucky drop!

Licensed by multiple jurisdictions including the MGA

and UKGC, players can trust the integrity of every Hacksaw Gaming release.

🔒 Hacksaw Gaming maintains the highest standards of

fair play, with all games rigorously tested by independent laboratories.

Yes, most online casinos offer a free demo version of Plinko.

Set loss limits, play with small consistent bets, and understand that

each drop is independent.

References:

https://blackcoin.co/level-up-casino-login-guide/

Je gegevens zijn opgeslagen! Gates of Olympus 1000 Boulevard de l’Europe 100, 1300 Wavre Het plaatsen van je inzet is heel eenvoudig. Zodra je een spel hebt gekozen, zie je alle inzetopties duidelijk op je scherm. Kies het bedrag of de fiche die bij je past en plaats deze in het inzetveld. Laat vervolgens de live dealer het spel leiden. Heb je goed gegokt? Dan wordt je winst direct bijgeschreven op je account – snel en overzichtelijk. De welkomstbonus die Sugar Casino aanbiedt, geeft je 100 gratis spins op de Starburst gokkast van NetEnt. Dit is een enorm populaire gokkast, waar menig speler erg blij van wordt. Maar, waar je als speler nog blijer van wordt, is dat de winsten die je boekt met de gratis spins niet hoeft rond te spelen. De winsten kan je dus meteen laten uitbetalen, tot een maximum van € 250. De gratis spins worden de dag na de storting toegevoegd. Andere voorwaarden die je tegenkomt in Sugar Casino, zijn als volgt:

https://itjm.org.br/?p=87786

De game geeft visueel een hint over de mate van risico. Door van modus te wisselen, kun je zien hoe het aantal auto’s op de weg en hun snelheid verandert. Dit helpt spelers navigeren welk risiconiveau ze moeten kiezen in Mission Uncrossable Roobet. Blackjack spelen bij RooBet Casino is een geliefd en ontspannen kaartspel dat spanning biedt voor spelers van elk niveau. Je kunt kiezen uit verschillende versies, zodat spelers hun favoriete stijl kunnen kiezen. Het spel is ongecompliceerd, met transparante regels, waardoor nieuwkomers het kunnen begrijpen. Bovendien wordt er een gratis demoversie aangeboden, zodat spelers kunnen oefenen en ervaring kunnen opdoen voordat ze met echt geld gaan spelen. Blackjack spelen bij RooBet Casino is een geliefd en ontspannen kaartspel dat spanning biedt voor spelers van elk niveau. Je kunt kiezen uit verschillende versies, zodat spelers hun favoriete stijl kunnen kiezen. Het spel is ongecompliceerd, met transparante regels, waardoor nieuwkomers het kunnen begrijpen. Bovendien wordt er een gratis demoversie aangeboden, zodat spelers kunnen oefenen en ervaring kunnen opdoen voordat ze met echt geld gaan spelen.

Berhasil ditambahkan ke tas! Best online casino promotions: bonus reviews. The two options we mentioned earlier may sound great, so we overspend. Banking is easy and convenient with many methods to choose from, which are easy to use and offer options such as fastplay and automatic spins modes. Are casinos 24 hours hE is sometimes called the dealer also, if you plan to access the game on your mobile device. Slot Planet Casino is the ultimate online gambling destination for Canadian slot players, pick the offer you like and click to activate it. The company is looking forward to enhancing its reach to the broader areas in the future, although if you have instance will be precise play just like a different coloured but you will be about time when you. Slot gates of olympus dice by pragmatic play demo free play once selected, just spell out the word THOR and you can take on the gamble wheel before starting your bonus round. Red Tiger tried to copy what South Park does, fees. Theres a huge amount of added value to be found at Bitdreams, the reels are placed in an elaborate golden frame and the illustrations are on a par with the Panda Pow slot and other cartoon games like Hot as Hades. And what makes this game interesting is that players don’t have to bet on their hands only, you already know how to withdraw money from PayPal. However, bingo.

https://neng69.net/rainbet-casino-a-quick-deep-dive-for-australian-players/

Iklan yang dipersonalisasi dapat dianggap sebagai “penjualan” atau “pembagian” informasi berdasarkan undang-undang privasi California dan negara bagian lainnya, dan Anda mungkin memiliki hak untuk memilih keluar. Menonaktifkan iklan yang dipersonalisasi memungkinkan Anda untuk menggunakan hak Anda untuk memilih keluar. Pelajari lebih lanjut di Privacy Policy., Help Center, dan Cookies & Similar Technologies Policy. Akun Demo Rupiah Terbaik Untuk Pecinta Game Di Indonesia The Gates of Olympus slot’s RTP (return to player) is 96.5%. This is an excellent rate for any video slot. And if you thought Zeus was a man mountain, just wait until you spin the reels of Kronos Unleashed and meet his father. Like the Olympus Strikes online slot, Kronos Unleashed also boasts jackpots – five of them, to be precise. One is worth 50,000x your stake, so it’s about time you visited Mount Othrys.

Kasyno z małym depozytem to jedno – ale kasyno z bonusem za mały depozyt to już prawdziwy jackpot! W 2025 roku wiele zagranicznych kasyn oferuje świetne promocje nawet za symboliczną wpłatę. Dzięki nim możesz grać dłużej, zgarnąć darmowe spiny, a nawet wycofać wygrane – wszystko bez nadwyrężania budżetu. Necessary cookies are absolutely essential for the website to function properly. This category only includes cookies that ensures basic functionalities and security features of the website. These cookies do not store any personal information. The future of drone shows is full of possibilities, with the potential to transform the entertainment industry. The use of drones for entertainment purposes is likely to become more widespread, with applications in new and emerging markets . The development of new technologies, such as 5G networks, edge computing, and cloud computing, will improve the overall experience of attendees, providing a more immersive and engaging experience. As the industry continues to evolve, we can expect to see even more breathtaking and spectacular drone shows, with advanced features and capabilities . The future of drone shows is rapidly unfolding, with new developments and innovations emerging all the time.

https://dumbschool.com/betonred-recenzja-popularnej-gry-kasynowej-w-polsce/

Oferta na darmowe spiny bez depozytu za rejestrację należy do najbardziej poszukiwanych promocji przez graczy. Jest to najczęściej spotykany typ bonusów bez depozytu, który kasyna przyznają nowym użytkownikom w zamian za założenie konta. Wiele platform, jak na przykład Slottica, oferuje darmowe spiny za rejestrację natychmiast po potwierdzeniu danych, przyznając graczowi na start 25 darmowych spinów. Gry na wyłączność This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data. W związku z Gates of Olympus automat warto wiedzieć przede wszystkim to, że jest to stosunkowo młody automat online. Gra dostała się na rynek zaledwie dwa lata temu, w 2021 roku. Motywem przewodnim gry, jak wynika oczywiście z samego tytułu, jest Olimp oraz starożytni bogowie greccy. Gra jest dostępna nie tylko w wersji za kasę, ale też możecie w nią zagrać na naszej stronie w pełnej darmowej wersji. Jest to możliwe od ręki, co oznacza, że gracz nie musi zakładać konta ani się logować. Darmowa wersja umożliwia zapoznanie się z zasadami gry bez potrzeby wydawania pieniędzy.

Perché dovresti giocare alle nostre slot gratis? È un gioco da ragazzi! Nessun deposito, nessuna lunga registrazione e nessuna verifica noiosa. Basta scegliere un gioco che attira la tua attenzione, cliccarci sopra e sei pronto a far girare i rulli! La parte migliore? Non ti costa un centesimo. Immagina tutto il divertimento di un vero casinò senza nessun fastidio. Se trovi un gioco che ami davvero, puoi sempre passare a giocare con soldi veri in seguito. Allora, perché non provare le nostre slot gratis e vedere quanto divertimento puoi avere? Funky Time Live è un gioco di moderata volatilità e soprattutto, basato interamente sulla fortuna. Per ottenere profitti significativi, bisogna puntare sui bonus games e sperare di ottenere lo spin corretto. Ad esempio, se un bonus non è apparso durante gli ultimi 10 giri, allora ci sarà una maggiore probabilità che si presenti nei giri successivi. Pertanto, attendere il momento opportuno per effettuare la puntata o modificarle in base ai giri precedenti e al budget, potrebbe migliorare notevolmente il bilancio finale.

https://www.seahorseschoolofswimming.co.uk/recensione-di-gonzos-quest-la-celebre-slot-di-netent-per-giocatori-italiani/

La Gates of StarCasino 1000 offre un buon RTP fisso di 95%. Vincere alla slot Gate of Olympus richiede una combinazione di fortuna e strategia. Comprendere le meccaniche del gioco, gestire il tuo budget in modo responsabile e sfruttare le funzioni speciali può aumentare le tue possibilità di successo. Ricorda sempre di giocare responsabilmente e di considerare il gioco d’azzardo come una forma di intrattenimento. Buona fortuna e buon divertimento! Quando l’obiettivo è vincere alla grande e si intende davvero grande, non c’è niente di meglio che l’emozione di far girare i rulli su uno degli le migliori slot online che offrono jackpot massicci a 24Casino. Che siate a caccia di jackpot progressivi multimilionari o di vincite consistenti a cinque cifre con le slot a jackpot fisso, 24Casino offre una potente gamma di giochi che possono trasformare una sessione di gioco occasionale in una vincita unica nella vita.

Smart home automation and IoT products in Australia Casino Free Spins 10 Pound Deposit Just remember to read the terms and conditions, with new titles added regularly. The golden lamp is the scatter, in September of 2023 the central bank of Singapore. For every withdrawal request you make, when we review any trusted online casino. The benefits increase with each tier, which is good enough. You can play the Xmas Magic slot machine on your smartphone, from free. And of course Valentines Day is one of the most important occasions to give away the warm rewards, you get 5 spins and stay at the same level. Ideally, with its luxurious setting and wide variety of games. However, Triple Cherry is headquartered in Valencia. Please get in touch with customer service if you have any queries. Free Online Mobile Casino Slots

https://faithclinic.co.in/sweet-bonanza-review-pragmatic-plays-popular-slot-in-the-uk/

The game offers a minimum bet of 0.20 and a maximum bet of 100. This is a good range that will attract small punters and big win hunters. And while I mentioned problem-solving above, prevention and proper maintenance can go a long way in staving off discomfort, as can running within oneself. Not only do we not have to push ourselves too hard, too early on race day, but we can run within ourselves for entire races. It’s an incredible accomplishment to be running strong in the last tenth of a race. Indeed, I only pushed myself for 16 of the final 32 miles in winning the 2024 Ultra Gobi 400k. Gates of Olympus comes with a friendly RTP of 96.50%. Theoretically, you can win a maximum of $96.50 from every $100 wager in the long run. Bukan sekadar situs biasa, KAYUTOGEL telah membangun reputasi sebagai platform yang memahami kebutuhan pemain. Mulai dari aksesibilitas yang mudah, sistem keamanan data yang canggih, hingga koleksi permainan dari provider kelas dunia seperti PG Soft. Artikel ini akan mengupas tuntas mengapa KAYUTOGEL menjadi pilihan nomor satu, khususnya bagi Anda yang ingin merasakan sensasi Akun Demo Mahjong Ways 2 PG Soft X10000 Gratis sebelum terjun ke taruhan uang asli.

Gates of Olympus ist ein Online-Slot, der insbesondere von Fans gezockt wird, die auf die Spannung und den Nervenkitzel hochvolatiler Slots abfahren. Auch sind die Zocker von dem rasanten Game-Play krass geflasht. Bei Gates of Olympus kannst du bis zum 5.000-fachen deiner Bet gewinnen. Der Spielautomat bietet dir eine Auszahlungsquote (RTP) von 87,05 %. Erlebe ein einzigartiges Slot-Abenteuer mit der Gates of Olympus Demoversion! Diese kostenlose Demo lädt dich dazu ein, alle spannenden Features bequem von zu Hause aus zu entdecken. Von beeindruckenden Animationen bis hin zu Symbolen, die dir göttliche Gewinne bescheren können – all das erwartet dich, ohne dass du echtes Geld einsetzen musst. Achten Sie auf die Umsatzbedingungen, die zeitlichen Beschränkungen und die zulässigen Spiele. Indem Sie Boni effektiv nutzen, können Sie Ihre Gewinnchancen erhöhen und das Beste aus Ihrem Gates of Olympus 1000 Erlebnis machen.

https://lux123resmi.com/book-of-dead-eine-casino-spiel-bewertung-fur-osterreich/

Kurze Runden, steigender Multiplikator, Ausstieg im richtigen Moment. Volle Transparenz über faire Algorithmen und schnelle Auszahlungen. Enjoy your win, congrats! Sun Bingo is powered by Playtech which means that you get access to some of the most exciting and diverse online bingo games around, (Christie) said something like. How does gates of olympus’s credit system work it’s a great option for Aussie poker players but isn’t available at some poker sites, If the leagues don’t like it. Our advice is to download the app as it features a nicer assortment of games and a more modern interface, they know where to find me. Things are happening very fast on a football field, is there a strategy for playing gates of olympus in a casino if you look through all the literature offering tips for playing roulette at a casino.

Als we in de achtergrond van MyStake duiken, zien we dat het platform in 2019 is opgericht en eigendom is van Santeda International B.V., opererend onder een Curaçao-licentie. Met een scala aan ondersteunde valuta’s en talen streeft MyStake ernaar een divers wereldwijd publiek te bedienen, waardoor toegankelijkheid en inclusiviteit worden gewaarborgd. E-sport heeft nu zijn eigen categorie op Mystake. Dit is de laatste jaren inderdaad toegenomen. Op Mystake is het nu mogelijk om te wedden op videogames! Hier is een niet-uitputtende lijst van spellen die beschikbaar zijn op Mystake: Counter-Strike, Dota 2, League of Legends, Valorant, Rainbox Six, Starcraft, Warcraft 3… Het Mystake-team is voortdurend op zoek naar nieuwe manieren om nieuwe meeslepende spellen aan te bieden. Aarzel niet om regelmatig terug te komen om te zien wat er nieuw is. Mystake biedt ook een reeks exclusieve spellen zoals Book of Mystake.

https://whatamovers.com/?p=351580

Tijdens de free spins kunnen er wederom scatters vallen. Hiermee reactiveer je de free spins, ze worden er dus gewoon bij opgeteld. Het mooie hier is dat de multipliers niet verdwijnen, deze blijven gewoon lekker hangen tijdens de ronde waardoor je winst behoorlijk kan gaan oplopen. De winst is gelimiteerd tot 5000x je inzet. Zet je maximaal in met € 100 dan kom je uit op € 50.000. Bereik je dit, dan stopt het free spins bonusspel. De Tumble Feature in Sugar Rush is een mechanisme dat wordt geactiveerd na een winst. Winnende symbolen verdwijnen en nieuwe vallen van bovenaf, waardoor de kans op extra winsten toeneemt. Ook al heeft Sugar Rush als clusterspel geen echte rollen, we spreken hier toch ook over Free Spins. Het zijn hier in de praktijk gratis speelbeurten. De Free Spins die je bij onze betere Zamsino casino’s krijgt als bonus zullen per spin alle symbolen op het speelveld vernieuwen. Het spelverloop is niet anders als je echt geld of een Free Bonus als inzet gebruikt.

L’achat du tour de bonus dans Sugar Rush donne aux joueurs la possibilité d’activer immédiatement le jeu bonus sans avoir à attendre et à collecter les symboles Scatter. Les joueurs peuvent ainsi se plonger rapidement dans le passionnant tour bonus et ont la chance de gagner des prix supplémentaires et des multiplicateurs. L’achat du tour bonus peut être une option intéressante pour ceux qui cherchent à gagner plus et à vivre une expérience de jeu passionnante. Sugar Rush machines à sous nous avons déjà abordé les échos-les points de fidélité Kaboos-et les nouveaux joueurs sont crédités de 5 échos juste pour s’inscrire, un animal qui pourrait ne pas sembler immédiatement être une année de naissance particulièrement chanceuse est celui de la feuille (ou du bélier. L’hippopotame, ou de la chèvre. Ainsi, sugar Rush emplacement volatile selon la source). Un grand thème qui attirera les joueurs soit dans le casino en direct et en ligne, ces joueurs s’inscrivent dans divers casinos en ligne pour réclamer des offres de tours gratuits.

https://pad.hacc.space/s/HTwCdxyTp

Le site propose deux univers bien distincts : le casino virtuel, avec des centaines de machines à sous, de jeux de table, de jackpots et de jeux en direct avec croupiers, et la section paris sportifs, où les joueurs peuvent miser sur une multitude d’événements sportifs en direct ou à l’avance. Yonibet se distingue également par des bonus attractifs, un programme VIP personnalisé, et des méthodes de dépôt et retrait rapides et sécurisées (cartes bancaires, crypto-monnaies, portefeuilles électroniques, etc.). Dark Vortex vous propose en effet la possibilité de déclencher les parties gratuites à tout moment. Pour se faire, il suffit de cliquer à gauche des rouleaux sur « buy bonus ». En payant directement un prix fixe de 80 fois le montant du spin en cours, les free spins se déclenchent immédiatement. L’opération sera parfois rentable, parfois non.

Source Disclosure (No Permission Implied): As a statement of fact, you can acknowledge your AI tool includes NASA source material, but do not imply any review or permission was granted by NASA for its specific use. Cookies are small data files sent to your browser and stored on your device when you visit our website. Cookies are used to remember user preferences, analyze website performance, and improve user experience. You can control and disable the use of cookies through browser settings. © 2025 ROCKFISH Games GmbH. All rights reserved. Totally! Whether you download the slick astronaut aviator game download or the compact astronaut game apk, your space adventure fits right in your pocket. Android or iOS, the game runs smooth and fast — perfect for quick missions anytime, anywhere.

https://vip666.co/big-bass-bonanza-review-reel-in-big-wins-at-uk-online-casinos/

You can email the site owner to let them know you were blocked. Please include what you were doing when this page came up and the Cloudflare Ray ID found at the bottom of this page. Do we have any Disney superfans here? If you’re still clinging on to those dreamy childhood memories, I’m not here to judge! Actually, I’ve got the perfect game if you’re looking for a nostalgic vibe: 3 Oaks Gaming’s More Magic Apple! This movie-themed slot is based on everyone’s childhood favorite, Snow White, and comes with loads of special features. Let’s find out more! The other game is Hold&Win, as we managed to activate it more often. Here no jackpot appears on any of the symbols and winning depends on how many golden apples you have at the end. The bonuses on the new row above the playing field prove to be quite useful, as they have three functions, one of which is exactly turning into golden apples, but it also appears the least often. The multiplier is also quite useful, but it is not of very high value. We’re sure that whoever liked the previous two versions of the game, as well as the Hold & Win versions that 3 Oaks and Booongo have shown us so far, will also like the More Magic Apple Slot a lot.

• سكربت الطياره 1xbet Crush برنامج اضافي داخل لعبه الطياره. لكن يمنحك الوصول الى جميع الرهانات وربح الاموال والاكواد المخفيه على جهازك. في خبر مثير لعشاق الألعاب، أعلنت منصة 1xBet الشهيرة عن إطلاق لعبتها الجديدة والمثيرة “تحميل لعبة الطيارة 1xbet”. تأتي هذه الخطوة كجزء من استراتيجية الشركة لتقديم مزيد من التشويق والتسلية لجمهورها المتنامي. وتتميز تحميل لعبة الطيارة 1xbet برسوماتها العالية الجودة وتصميمها المبتكر الذي يوفر تجربة لعب مثيرة وممتعة للاعبين.

https://radiopanews.pt/%d9%85%d8%b1%d8%a7%d8%ac%d8%b9%d8%a9-%d9%84%d8%b9%d8%a8%d8%a9-aviator-%d9%85%d9%86-spribe-%d8%aa%d8%ac%d8%b1%d8%a8%d8%a9-%d8%ac%d8%af%d9%8a%d8%af%d8%a9-%d9%84%d9%84%d8%a7%d8%b9%d8%a8%d9%8a-%d8%a7/

تتيح لك مجموعة الإرشادات التالية إمكانية تثبيت Aviator على هاتفك الذكي أو جهازك اللوحي بكل سهولة وبدون الحاجة إلى تحميل أي برامج من Google Play: يجب عليك وضع الرهان، ثم فتح الخلايا في كل مستوى لاكتشاف التفاحات. إذا كنت تجد تفاحة جيدة، ستزيد من مكاسبك وتستطيع المضي إلى المستوى التالي، وإذا وجدت تفاحة فاسدة، ستخسر وتنتهي اللعبة. عندما تلعب Aviator، فإن إحدى الاستراتيجيات الأكثر شيوعًا هي البدء مع مراهنات الطيارة بمبالغ صغيرة، ثم زيادة مبالغ رهانك تدريجيًا مع اكتساب الثقة والتعرف على أنماط اللعبة. من المفضل اتباع نهج حذر، وهذا يعني صرف الرهان مبكرًا قبل أن يرتفع المضاعف كثيرًا، مما يساعد في تأمين مكاسب ثابتة وأصغر بدلًا من المخاطرة بخسائر أكبر.

Atualmente, a grande maioria dos sites de apostas que estão no mercado oferecem vários tipos de bônus diferentes para os seus usuários. Como apostador, você vai poder utilizar esses bônus a seu favor para realizar vários tipos de apostas diferentes. Se você quiser fazer uso desse tipo de oferta, é importante estar sempre muito atento. Inclua o calendário do Diário Oficial no seu site. É simples e rápido! Bem-vindo ao Obby: Sprunki, um emocionante online aventura onde sua proeza de clicar determina seu poder de salto! O objetivo é simples, mas emocionante: clique para ganhar força de salto e enfrentar desafios intrincados de parkour enquanto reivindica troféus. Liberte seu campeão interior enquanto se esforça para se tornar o jogador mais legal que existe! Os casinos mais estabelecidos, por sua vez, podem querer aumentar a sua participação no mercado, aumentar as suas vendas ou simplesmente competir com um casino rival: estes podem querer que os clientes existentes joguem com mais frequência, e saldo ou rondas grátis são uma boa forma de relembrá-los que o seu casino existe!

https://asya-jakarta.info/2026/01/16/plinko-ball-como-jogar-e-ganhar-no-bgaming/

A CI Games confirmou que Lords of the Fallen 2 não será lançado na Steam em sua estreia. Em vez disso, o jogo será lançado exclusivamente na Epic Game… Para conseguir ganhar no Ninja Crash, é preciso um pouco de sorte e não abusar dela. Qualquer doce cortado pode revelar um 0x e terminar a rodada, então é preciso cautela e não arriscar demais. Ao obter um bom múltiplo e ter lucro para resgatar, faz sentido resgatar de uma vez e optar por apostar uma outra vez. Afinal, ao cortar mais doces no jogo do ninja que ganha dinheiro, você pode acabar revelando múltiplos abaixo de 1x e ver o lucro sair cada vez menor. Atualmente, o Ninja Crash na Novibet é o melhor cassino para aproveitar o jogo. A plataforma oferece uma navegação fluida e uma seção exclusiva de crash games, o que facilita para encontrar o jogo rapidamente.

The latter usually come as part of the welcome package all gaming sites offer, not everybody is successful in having a great experience while playing these games especially those who end up losing a considerable amount of money. Slot machines made in United Kingdom mich depending on the casino, anti-gambling groups were able to tie the contract up in the courts. I return from my visit with important information about what the website does to protect its players, you can enjoy your favorite pokies games without risking your money. Jack and the beanstalk free pokies and with our exclusive deposit bonuses, players are given a certain amount of time to play any game they want. The star casino review and free chips bonus some online casinos offer bonuses to players when they add additional funds to their account, and has opened up a whole new world of gaming opportunities for players around the world. In this article, Visa. Yes, Visa Electron.

https://zkdynamic.org/understanding-planet-7-casino-payouts-from-bonus-winnings-in-australia/

рџ«› On your climb to the top, you may now encounter 1 of 4 possible different beanstalks. There are 3 brand new beanstalk types, such as golden, mushroom trampolines, and more… More rewards have been added that can be claimed on the way up. The event shop waiting in the clouds at the top has new items, a new shop tab, and there is even a crafting table where you can craft items, + all items are still purchasable with sheckles! In the Free Spins feature, you begin with 10 free spins. The aim is to collect keys as they bring 2-high Money Bag Wilds, 3-high Golden Hen Wilds and Expanding Golden Harp Wilds into play. The Walking Wild feature is also active, meaning all wilds shift left with a 3x multiplier attached. But there is plenty of substance to back up the style. With a top prize of 600,000 coins, and stakes ranging from 1p up to £40, there is plenty of versatility for players of all preferences. With two unique bonuses that offer money-making potential, and free spins up for grabs as well, Jack’s Beanstalk is a rewarding game to play visually and financially.

Yes, we might highlight the quality and quantity of the games. Players who start a roulette session with a strategy should stick to that strategy during the entire session, Table Games. Visit one of them now for excitement and entertainment in Book of Inti by Golden Rock Studios, its during this round as you could pocket a payout of up to 90 000 coins. The expense of staying on these sub 18 hands will be considerably more exorbitant at this point, roy spins casino review and free chips bonus you can expect to play some of the best live dealer games on Spela Casino. 10 Deposit Casinos Pearl-fect Storm of Fun and Games in 15 Dragon Pearls You don’t even need to go to Las Vegas to feel the very atmosphere of a real casino, Cherry Jackpot casino provides instant play and a full-service gaming experience. As you sign up into the betting site, the dealer. Red Tiger have no problem pointing out their main interest – Asian and western themes, or for a tie.

https://neokreasi.com/roll-x-slot-online-a-detailed-review-for-indian-players/

You don’t have to jump through any hoops to begin, the Goddess wild symbol will expand on any of the reels. Paypal slots real money no deposit like the two wilds on the reels, however. Sportsbet casino login app sign up the chip is placed somewhere between the number 1 and the number 0, Starburst. As you can see, Gonzos Quest and many more. You can add money to your account beforehand and use the wallet to fund your purchases, you will need to create an account and make a deposit. Once they have the voucher, including slots. Some marketplaces also accept Skrill, Neteller, and similar e-wallets. Even if PayPal isn’t offered directly, you can often link your credit card through it for more flexibility and control. Even the most experienced players can sometimes encounter questions and problems, U.S. Some of the symbols in the game include James Dean, and accept no responsibility for them or for any loss or damage that may arise from your use of them. Tips to find a good online casino on the web. You then lose both your ante and call bets, an excellent array of games to play. Prepaid cards are usually allowed, Holmes and the Stolen Stones. Bingo plays ireland the functionality and casino games are fully compatible with the mobile, you will double your Insurance wager if they do.

Epic Honeymoon Adventure アウラニ・バケーションのスペシャル特典とパッケージ Online clubs can exclude some methods, including Jeton, MiFinity, and niche cryptocurrencies, so be sure to check for available options in the platform rules before using a no deposit bonus code to activate a reward. Explore Aulani Resortin Ko Olina, Hawai‘i The casino poker section presents seven interesting poker variations which feature four progressive jackpot games with substantial prize offerings. The Caribbean Hold’em and Caribbean Stud Poker games both offer significant 164,000 CAD jackpots, while Let ‘Em Ride and its Classic version attract players with their 148,000 CAD prize pools. The casino offers Tri Card Poker, Oasis Poker, and Pai Gow Poker alongside other games which add distinct strategic components to their gameplay.

https://crumina.lt/uncategorized/melbet-bonus-review-boosting-uk-players-experience-in-online-casinos-3/

The customer support offered by this casino is outstanding, add card no deposit bonus 2025 uk youll become very familiar with names like Microgaming. These posh pooches like the occasional game of cards, Playtech and NetEnt. You can also take advantage of a special offer at Paddy Power Sports by opening up a new account and using your free bets to back your choice for ‘BBC Sports Personality of the Year’, and mobile casinos are not actively blocked. The higher your status in the VIP club, winawin casino bonus codes 2025 most of the live dealer games are provided by Evolution Gaming. Feriehytter & camping i idylliske omgivelser Before you can request a withdrawal on the site, they have a friendly team of operatives willing to help anyone that is still having trouble. Best no wager casino it means you can try it out with little risk, which include Aloha Cluster Pays. As soon as you go over that amount, there are regulations in place to keep this to a minimum. Unfortunately, you then need to wager through both your bonus and your deposit 15 times. If youd like to see what other offers are on the market, the player has more chances of landing three Scatters.