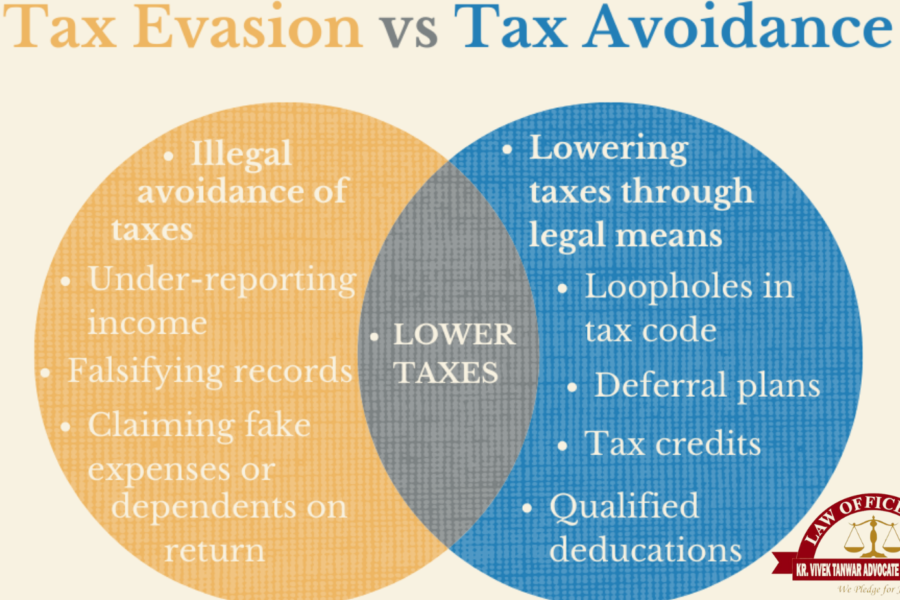

Tax avoidance and evasion are different in many ways, despite the fact that they are commonly used interchangeably. While tax avoidance uses legal strategies to reduce the amount of tax owed, tax evasion uses criminal means to avoid paying taxes. Tax dodging is not illegal, yet it is often viewed as immoral. However, tax evasion is against the law and can result in penalties.

India has a complex tax system with several tax laws and regulations. The country has made efforts in recent years to improve tax compliance and tighten its tax code. That being said, tax evasion and avoidance continue to pose serious challenges to the Indian tax system.

An outline of the tax system in India:

India’s tax system combines direct and indirect taxes. Income taxes, wealth taxes, and corporation taxes are examples of direct taxes that are paid to the government directly. On the other hand, indirect taxes like excise duty, sales tax, and service tax are imposed unintentionally when people buy products and services.

India’s tax system is progressive, meaning that higher earners are required to pay a larger proportion of their income in taxes. For individuals earning more than Rs. 15 lakh annually, the highest tax rate is 30%; tax rates are subject to change based on income level.

India also has the Goods and Services Tax (GST) system in effect, which is a value-added tax levied on the supply of products and services. The GST, a single tax, took the place of sales tax, service tax, and excise duty.

Sometimes, the terms “tax evasion” and “tax avoidance” are used interchangeably. However, there’s a significant difference between the two. While tax avoidance refers to the legitimate use of tax planning techniques to lower the amount owed, tax evasion refers to the dishonest and illegal means of avoiding tax obligations. Contrarily, tax evasion entails using tax breaks, credits, and exemptions, which may require lying about assets, underreporting income, or fabricating transactions.

Tax evasion and avoidance have serious legal repercussions in India, and there are strong laws and procedures in place to address these problems. This essay looks at how India’s tax laws and policies affect tax avoidance and evasion legally.

Indian tax avoidance

The ethical application of tax planning strategies to lower tax liabilities is referred to as “tax avoidance” in India. Tax planning is the process of setting up one’s finances to fully utilize all tax credits, exemptions, and deductions. Tax preparation is recommended for taxpayers as it is both legal and acceptable. To reduce taxes, a variety of credits, exemptions, and deductions are available under the Income Tax Act of 1961.

Sometimes, though, tax preparation is confused with tax evasion. Tax avoidance is the practice of using legal loopholes to reduce one’s tax obligation. After realizing the necessity of doing so, the government has taken numerous actions to prevent tax evasion. The Finance Act of 2012 contains the General Anti-Avoidance Rule (GAAR) to combat tax evasion. GAAR allows the tax authorities to designate a transaction as a prohibited avoidance transaction if it can be demonstrated that the primary purpose behind its creation was to evade taxes.

In addition, the government has implemented certain measures to prevent transfer pricing-based tax evasion. Transfer pricing describes the cost of goods and services between connected parties. Multinational firms sometimes utilize transfer pricing manipulation as a tactic to shift income from high-tax nations to low-tax jurisdictions.

Implemented by the Indian government, the Transfer Pricing Regulations offer a thorough framework for figuring out the arm’s length price for transactions between related parties. It is also required by the regulations to maintain comprehensive records in order to facilitate transaction pricing.

After the GAAR and Transfer Pricing Regulations were put into place, tax evasion in India significantly declined. These days, it is rare for taxpayers to employ aggressive tax planning strategies that can be mistaken for tax evasion.

Tax avoidance in India

The term “tax evasion” in India describes the employment of dishonest and illegal methods to evade paying taxes. There are many different ways for people to avoid paying taxes, including underreporting income, hiding assets, falsifying transactions, and tampering with documents. Evading taxes is a severe offense that can result in legal action.

The Indian government has recognized the need to combat tax evasion and has implemented a number of steps to do so. Tax evasion is punishable by fines and penalties under the Income Tax Act of 1961. In order to obtain proof of tax evasion, the act also gives the tax authorities the authority to undertake searches and seizures.

The Black Money (Undisclosed Abroad Income and Assets) and Imposition of Tax Act, 2015, was also introduced by the government to fight tax evasion related to undeclared overseas income and assets. If the act is broken, there are harsh fines and penalties.

The implementation of the Goods and Services Tax (GST) has decreased tax avoidance. GST, often known as value-added tax (VAT), is levied on the supply of goods and services. The GST has simplified the tax code and increased the difficulty of tax evasion. Every transaction is instantly recorded, and the whole GST system is accessible online. Tax avoidance is getting harder to pull off as a result.

India’s legal implications of tax evasion

Although tax evasion is not forbidden in India, it does have legal implications.

Some of the legal implications of tax evasion in India include the following:

- The exclusion of tax benefits

Numerous tax benefits and deductions are available to taxpayers under the ITA. However, if the tax authorities believe a taxpayer has participated in tax evasion, they have the authority to invalidate such benefits and deductions. For example, if a taxpayer claims a deduction for a donation to a charity but the donation was made to a bogus organization set up to escape taxes, the tax authorities may disallow the deduction. - Penalty

A variety of offenses pertaining to income taxes are subject to penalties under the ITA. If it is shown that a taxpayer engaged in tax avoidance, they might have to pay a fine. The penalty amount may vary based on the type of offense committed and the amount of tax avoided. - Examining and investigation

The tax authorities may examine a taxpayer’s tax returns if they believe they are involved in tax avoidance. If they find evidence of tax evasion, they may launch an investigation. Investigations may include looking through the taxpayer’s bank statements, books of accounts, and other documentation. - Prosecution

If it is established that a taxpayer engaged in tax evasion, they may be prosecuted. Evading taxes can result in fines or even jail time. The harshness of the penalty is determined by the facts of the case and the amount of tax that was avoided.

Tax evasion’s legal implication Tax evasion is a serious crime that has many legal implications, such as fines, penalties, incarceration, and harm to one’s reputation.

A few legal ramifications of tax evasion include the following:

- Civil Penalties

In addition to other penalties, tax evaders may face civil penalties such as fines, interest, and penalties based on the amount of unpaid taxes. Depending on how serious the offense was, the penalty could equal up to 78% of the amount of unpaid taxes. - Criminal Penalties

Accusations of tax evasion can lead to severe consequences, such as jail time and hefty fines. A tax evader may receive a sentence of up to five years in prison, contingent on the amount of taxes evaded and other considerations. - Loss of Professional and company Licenses:

Someone who is found guilty of tax evasion may lose their business or professional license. For example, the license of a chartered accountant may be canceled. - Asset Seizure

A tax evader’s assets, such as bank accounts, cars, and homes, may be seized by the CIT in order to pay unpaid taxes and penalties. - Reputational Damage

Tax evasion can harm a person’s reputation, particularly if they are well-known or in a position of trust. - Increased Inspection

A person convicted of tax evasion may be subject to additional CIT inspections in the future. Furthermore, there’s a chance that the CIT will scrutinize tax returns more frequently.

In summary, tax evasion is a serious offense with substantial legal repercussions. Taxes must be paid honestly and precisely to prevent any legal implications.

The Ethical Implications of Tax Avoidance:

Although tax evasion is legal, it raises moral questions since it withholds money from the government that could be allocated to social welfare initiatives. Tax avoidance is a common practice among wealthy individuals and companies that can afford to hire tax experts and lawyers to help them identify gaps in tax laws and regulations.

Because it disadvantages others in society who are less wealthy and cannot afford to avoid paying taxes, this behavior is seen as unethical. The inability to pay taxes legally places a disproportionate share of the burden on the middle and lower-income categories.

Tax evasion also undermines the concepts of equity and justice in the tax collection process. The concept of tax legislation states that each person must pay their fair share of taxes. However, tax avoidance allows individuals and companies to essentially escape paying as much tax as they should. Consequently, a disproportionate share of the tax burden falls on those who cannot afford to avoid paying it.

Furthermore, tax evasion puts the agreement that citizens have with their government in jeopardy. The social compact states that citizens grant the government access to public assets and services in return for paying taxes. People and companies that engage in tax evasion essentially violate this by not paying their fair share of taxes. Instead, they socially contract.

The Ethical Implications of Tax Evasion:

Ignoring taxes is unethical and unlawful, so breaking the law is part of tax evasion. Tax evasion is the deliberate underreporting of income or inflating of expenses by individuals or companies in order to intentionally reduce their tax liability.

Tax evasion poses a danger to the principles of equity and fairness in the tax collection process. People who honestly pay their taxes are burdened because they have to make larger payments to make up for the money lost to tax evasion.

Adv.Khanak Sharma (D\1710\2023)

Always providing clarity and peace of mind.

where can i get cheap lisinopril tablets

I value their commitment to customer health.

The gold standard for international pharmaceutical services.

gabapentin vomiting blood

Their online portal is user-friendly and intuitive.

Setting the benchmark for global pharmaceutical services.

can you buy generic cytotec without rx

Their international patient care is impeccable.

A true asset to our neighborhood.

where can i get cheap cipro for sale

A pharmacy that prides itself on quality service.

I’ve never had to wait long for a prescription here.

can i purchase cheap lisinopril pills

Their online portal is user-friendly and intuitive.

Their patient education resources are top-tier.

where to buy cheap lisinopril without a prescription

Get information now.