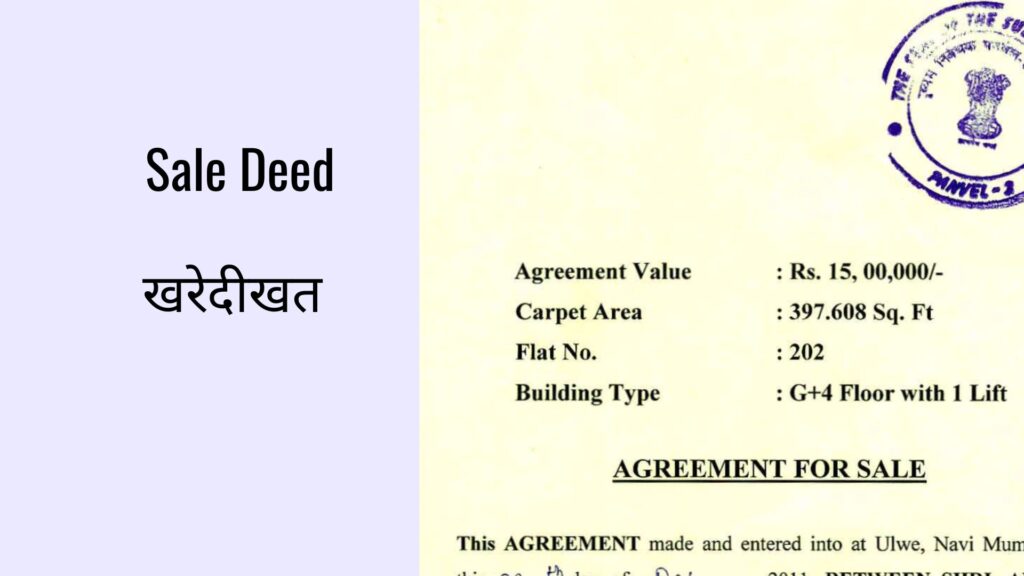

When purchasing a property, the buyer and seller sign a sale deed, which is a legal document that completes the transaction. Through a selling deed, ownership of the property has been passed from the seller to the buyer. The parties may refer to the vendor and the buyer or transferee. Before signing the sale deed, the parties typically concur on the terms and conditions. The sale deed, which acts as proof of the transfer of ownership, contains specifics on the terms of the property as well as the parties’ rights and obligations.

Parties Involved in the Sale Deed

The seller and the buyer are the two parties listed in the sale deed. The buyer, also known as the transferee, receives ownership of the property once the seller, commonly known as the transferor, transfers ownership. The legislation allows any competent individual, entity, or corporation to take part in the transfer of any kind of property.

Definition:

According to Section 54 of the Transfer of Property Act, 1882, a “sale” denotes the transfer of ownership in return for a price that has been paid, promised, or partially paid and partially promised.

A signed legal document known as a deed is used to give ownership of an item to a new owner. The most popular usage of deeds is when two people want to exchange ownership of a car or piece of property. A deed is used to transfer title, or the rightful ownership of a piece of real estate or other asset, from one individual or business to another.

Objective of sale deed?

A sale deed is a formal written document that enables the owner of real estate to give away all of their rights to a buyer in return for money. The last document needed to transfer ownership of a piece of property is a sale deed.

Elements of a Sale Deed

When creating the sale deed draft, several essential components are included in the document. Following are the things that must be a part of the sale deed draft.

- Details of Both the Parties: Details in terms of the name of both parties, contact numbers, and age are recorded in the sale deed draft.

- Property Details: This section includes the property’s details, such as its complete address, area of the property, including the dimensions, details of construction.

- Indemnity Clause: This particular clause is added to the property to ensure that the seller frees the buyers from all the previous taxes, loans, and charges related to the property. Also, the seller will pay up any mortgages and loans before finalizing the sale of the property.

- Payment Details: The price at which the owner will sell the said property should be specified in the sale deed. Along with the sale price of the property, the information related to the advance payment made by the buyer must be stated clearly in the sale deed. Information on the amount paid in instalments, date of each instalment should also be mentioned in the document.

- Mode of payment: The method of payment, i.e., how the amount will be made for the property purchase, must be recorded explicitly in the sale deed. The standard modes of payment, such as bank transfer, cheque, and cash, are clearly stated in the sale deed.

- Possession of Property: The sale deed will record the date the buyer will get possession of the property.

- Witnesses of the Property: The testimonium clause of the property includes that two witnesses are mandatory for attending the sale deed. At least one witness from both sides, i.e., buyer and seller, should sign the sale deed. The witness has to share their complete name, address, and age.

Furthermore, the property seller is required to provide the buyer with certain statutory disclosures in the selling deed. These disclosures cover, among other things, material faults in the property, the declaration of any disputes, the proper execution of the conveyance of the property, and the payment of any applicable taxes and other expenses. The sale deed’s execution lowers the risk for both parties because it precisely outlines all of their rights and obligations.

Difference between a Sale Deed and a Sale Agreement

Following are the significant differences between the sale agreement and the sale deed.

| Sale Deed | Sale Agreement |

| A sale deed is a document that refers to the immediate and complete sale of the property. | A sale agreement is a document that indicates the sale of the property sometime in the future. |

| Under the sale deed, any risk borne or associated with the property is the responsibility of the buyer. | Until the sale of the property, the responsibility of bearing the risk is taken care of by the seller. |

| A sale deed is a contract that has been executed. | A sale agreement is a contract that is yet to be executed in the future. |

| It is mandatory to register a sale deed. Also, during the registration process, the buyer is liable to pay the stamp duty. | Based on the rules of state related to the sale agreement, it may or may not be registered. |

| Under the sale deed, the rights and claims of the property are handed over to the new owner. | The sale agreement only gives the person the right to purchase a property in the future. |

| The sale deed includes information related to both the parties involved, property and payment details, along with other information. | The sale of the agreement only includes terms and conditions based on which the sale of the property will be executed. |

Getting a Certified Copy of Sale Deed

Now that its significance has been recognised, the property owner should take every precaution to ensure that the sale deed is kept up to date. Nonetheless, the property owner is required to notify the nearby police station if they ever misplace the sale deed.

The property owner receives a non-traceable certificate after submitting the complaint (FIR) at the police station. Post a notice regarding the loss of the sale deed in the press following the issue of the non-traceable certificate. Ad needs to have all the necessary information. The next step is to apply for a certified copy of the selling deed and file an affidavit with the sub-registrar office.

The affidavit, which needs to be notarized, needs to have an advertisement, a copy of the FIR, a non-traceable certificate, and details on the property attached. The affidavit also needs to include a signed pledge attesting to the accuracy of the information provided. A certified copy of the selling deed must also be obtained by paying a certain amount. Within two to four weeks following the procedure’s completion, a certified copy of the selling deed will be distributed.

What is the Sale Deed Number?

The Sale Deed Number is generated upon the document’s registration, payment of the registration costs, and stamp duty. The selling document number is on the payment slip. It is also noted on the upper right corner of each page in the whole selling deed paperwork.

The sale deed number is formatted as follows: Document Number/Year/Sub Registrar Office Initials

Sale Deed Documents Required for Property Registration

Here are a few major sale deed documents required for property registration.

- Sale Agreement

- Title: Deed Draft

- Extract

- Sharing agreement signed by the builder and property owner

- Allotment Letter from the Housing Board

- Power of Attorney, if any

- No-Objection Certificate, in case of property resale

- Blueprint of the authorised parties

- Completion Certificate

- Property tax receipts

- Encumbrance Certificate

- Stamp Duty Receipt

- Identity proof of all the parties and witnesses involved

- Possession Letter

- Property papers from the bank, in case a loan has been taken against the property

- Occupancy Certificate

- Passport-size photographs

Is It Possible to Cancel a Sale Deed?

Losing the ability to buy a property is the same as the selling deed being cancelled. It can, however, only be cancelled under specific conditions. If any of the parties to a selling deed are unhappy with the conditions of the arrangement, they may cancel it. In a court of law, the alleged party must grant permission for the complaint of discontent. If one of the parties wants to cancel the sale deed, there must be a good explanation behind it. To have the sale deed annulled after the cause has been established, the petitioner needs to get a civil court order and give it to the registrar. The Special Relief Act of 1963 permits the cancellation under Sections 31 and 33. of the sale deed.

A sale deed can be cancelled for the following reasons:

- The deed was created under undue influence.

- The deed is void if a minor has executed it.

- Fraudulent activity in the creation of the deed, transfer, and transaction

- Misinterpretation of facts to get a deed signed

- If the execution of the sale deed can cause harm or injury to the petitioner,.

What to Keep in Mind When Executing a Sale Deed

Here are some important points to keep in mind when carrying out a sale deed.

- A provision transferring ownership rights to the buyer upon completion of the acquisition must be included in the selling deed.

- The property’s title must be clear of all encumbrances.

- The encumbrance status needs to be confirmed by the registrar’s office.

- All associated utility costs, such as those for power, water, property taxes, etc., must be paid.

- There should be no outstanding debts, including maintenance fees.

- Every term and condition under which the property has been sold must be detailed in the sale deed.

Conclusion

A sale deed is a crucial document that certifies ownership of real estate. The property, the buyer and seller, the price, and other details are all included in the sale paperwork. The buyer pays the stamp duty associated with documenting the selling deed. The selling deed must be kept current by the property owner. If the original sale deed is lost, it takes time to get a certified copy from the sub-registrar office. Since the registered sale deed requires the signature of at least one representative from each party, it may be questioned in the event of a disagreement.

ADV. KHANAK SHARMA