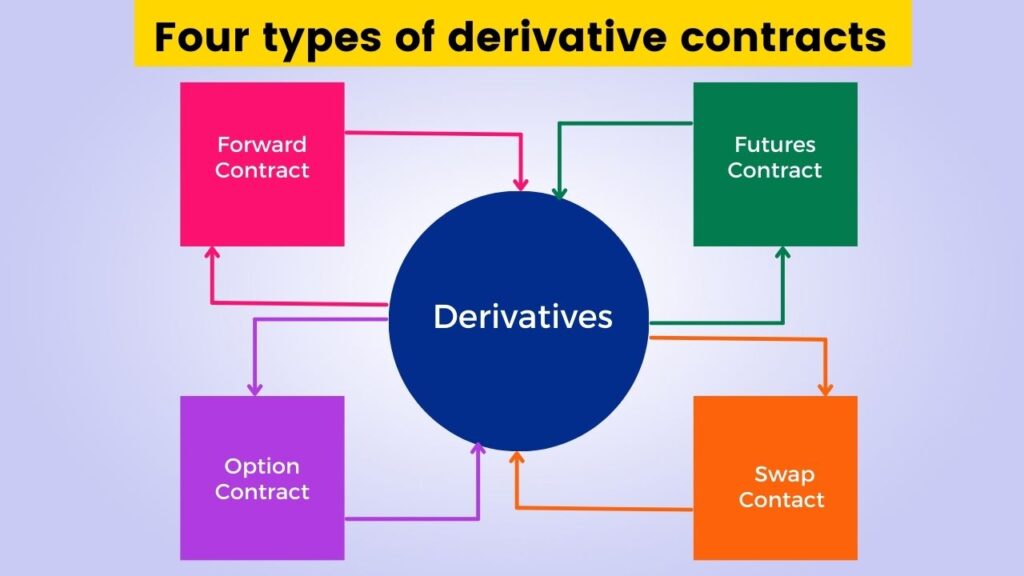

Abstract: Derivative contracts are essential financial instruments in India, contributing to risk management, price discovery, and market liquidity. This article provides an in-depth examination of derivatives contracts within the Indian legal system, focusing on forwards, futures, options, and swaps. It explores the regulatory framework established by Indian laws and sections, offering insights into their operation, regulation, and legal implications.

Introduction:

Derivative contracts have gained prominence in India’s financial markets, offering participants tools for managing risk and optimizing investment strategies. Understanding the legal framework governing derivatives contracts is imperative for market participants, regulators, and policymakers to ensure market integrity and investor protection. This article analyzes forwards, futures, options, and swaps within the Indian legal system, elucidating key laws and sections that shape their usage and regulation.

I. Forwards Contracts in India:

Forwards contracts involve agreements between parties to buy or sell an asset at a predetermined price on a future date. In India, forward contracts are primarily regulated by securities laws, exchange regulations, and contract terms.

A. Legal Framework:

- Securities Contracts (Regulation) Act, 1956 (SCRA): The SCRA regulates forward contracts and other securities transactions in India, providing legal recognition and enforceability to such contracts.

- Indian Contract Act, 1872: Forwards contracts are governed by the Indian Contract Act, which establishes the legal framework for contract formation, performance, and enforceability.

B. Regulatory Oversight:

- Securities and Exchange Board of India (SEBI): SEBI regulates forward contracts on securities and commodities, overseeing exchanges, clearing corporations, and market participants to ensure compliance with securities laws and regulations.

- Reserve Bank of India (RBI): RBI regulates forward contracts involving foreign exchange and interest rates, prescribing guidelines and regulations to manage currency and interest rate risks.

II. Futures Contracts in India:

Futures contracts are standardized derivatives traded on organized exchanges, facilitating price discovery and risk management. In India, futures contracts are subject to regulatory oversight by SEBI and exchange regulations.

A. Legal Framework:

- Securities Contracts (Regulation) Act, 1956: The SCRA provides the legal basis for futures contracts in India, defining their scope, regulation, and enforcement mechanisms.

- Forward Contracts (Regulation) Act, 1952 (FCRA): The FCRA regulates commodity futures contracts in India, prescribing rules for trading, clearing, and settlement of commodity derivatives.

B. Regulatory Oversight:

- SEBI: SEBI regulates futures contracts on securities and commodities exchanges, ensuring fair trading practices, investor protection, and market integrity.

- Forward Markets Commission (FMC): FMC was previously responsible for regulating commodity futures markets in India before its integration with SEBI in 2015, bringing commodity futures under SEBI’s purview.

III. Options Contracts in India:

Options contracts provide the buyer with the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified period. In India, options contracts are governed by securities laws, exchange regulations, and contract terms.

A. Legal Framework:

- Securities Contracts (Regulation) Act, 1956: The SCRA regulates options contracts on securities, establishing the legal framework for their trading, clearance, and settlement.

- SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015: SEBI regulations prescribe listing requirements and disclosure obligations for options contracts listed on stock exchanges in India.

B. Regulatory Oversight:

- SEBI: SEBI oversees options trading on securities exchanges, ensuring compliance with securities laws, exchange regulations, and investor protection measures.

- Clearing Corporations: Clearing corporations facilitate the clearing and settlement of options contracts, managing counterparty risks and ensuring the integrity of the settlement process.

IV. Swaps Contracts in India:

Swap contracts involve the exchange of cash flows based on the performance of underlying assets or financial variables. In India, swap contracts are subject to regulatory oversight by SEBI and RBI, along with adherence to contract terms and documentation standards.

A. Legal Framework:

- Reserve Bank of India Act, 1934: The RBI Act empowers RBI to regulate financial markets in India, including swaps contracts involving foreign exchange, interest rates, and other financial instruments.

- SEBI (Over the Counter Derivatives) Regulations, 2014: SEBI regulations govern over-the-counter (OTC) swaps contracts, prescribing registration, reporting, and disclosure requirements for market participants.

B. Regulatory Oversight:

- SEBI: SEBI regulates OTC swap contracts, ensuring transparency, market integrity, and investor protection in the OTC derivatives market.

- RBI: RBI regulates swaps contracts involving foreign exchange and interest rates, prescribing guidelines, and regulations to manage currency and interest rate risks in the financial system.

Conclusion:

Derivatives contracts, including forwards, futures, options, and swaps, play a crucial role in India’s financial markets, offering opportunities for risk management, speculation, and hedging. Understanding the legal framework governing derivatives contracts is essential for market participants to navigate regulatory requirements, mitigate risks, and ensure compliance with applicable laws. By examining key Indian laws and sections governing derivatives contracts, this article aims to provide a comprehensive analysis of their operation, regulation, and legal implications, fostering informed decision-making and promoting market integrity.

Adv. Khanak Sharma