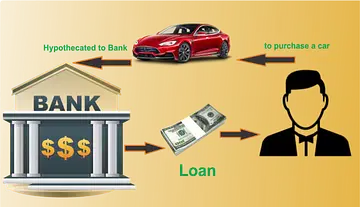

When a person obtains a bank loan to purchase a vehicle, this is referred to as hypothecation. Anyone who buys a car should be informed of the numerous payment options. You can either pay in full at the time of purchase or take out a bank loan. Because the bank contributed to the purchase of your car, it serves as collateral for the bank.

Hypothecation at the RTO-

When you buy a car with a loan, it is registered in your name at the Regional Transport Office (RTO). The vehicle’s Registration Certificate (RC) will bear your name. However, because the bank is the notional owner of the vehicle while the debt is unpaid, the RC will also include a note endorsing the vehicle in its favor.

Documents required for Hypothecation-

The following documents are needed while registering a vehicle purchased through a bank loan during RTO registration:

*The original Registration Certificate

*Car Insurance documents

*Form 34

*Proof of address of the vehicle owner

*Attested copy of the PAN card of the owner

*Pollution Under Control Certificate

*Receipt for the fee paid for endorsement of Hypothecation issued by the RTO.

When and how can you remove Hypothecation?

You can remove the Hypothecation from the title of your car once your bank loan is paid in full. This administrative process involves both the bank and the appropriate RTO. You cannot sell or transfer ownership of the car unless the Hypothecation is removed.

Your bank loan must be totally paid off in order for the Hypothecation to be removed. According to the bank’s records, no amount should exist against the requested loan. You have the option of pre-closing the loan or making payments after the loan’s term has expired. When the payment process is completed, the financing institution issues a No Objection Certificate, verifying that you have paid the bank’s outstanding sum in full.

Form 35, which serves as an application for cancellation of hypothecation, must be submitted. The form indicates that the loan between you and the bank has been closed. Once you have completed all of the relevant papers and paid the RTO fees, the officer will begin the removal process. Fees vary by state in the United States. Go to the website of the relevant RTO or transport authority to find out the needed pricing for your state. Once the Hypothecation is cancelled, the RTO will issue a new Registration Certificate.

Submit the Application for Hypothecation Removal-

You will need the following documents to complete and submit the application for hypothecation removal at RTO.

*Original registration certificate

*RTO copy of NOC

*Copy of your Driving License

*Copy of the PUC certificate

*Copy of car insurance policy

*Self-attested copies of Form 35

Benefits of HP Termination or Removal from RC-

Complete Ownership: The removal of hypothecation from the RC signifies that the loan has been repaid in full, granting the vehicle owner complete ownership rights. It empowers the owner to freely sell or transfer the vehicle without any encumbrances.

Resale Value: A vehicle without hypothecation on its RC holds a higher resale value in the market. Prospective buyers prefer vehicles with clear ownership, as it ensures a hassle-free transfer process.

Reduced Documentation: With hypothecation removal, owners are relieved from the burden of providing additional documentation and obtaining NOC (No Objection Certificate) from the lender during future transactions.

They stock quality medications from all over the world.

can i order cheap lisinopril online

Pioneers in the realm of global pharmacy.