Protection of Intellectual Property Rights During Mergers and Demergers

Abstract

Mergers and demergers are complex corporate restructuring activities that have significant implications for intellectual property (IP) rights. Ensuring the seamless transition, protection, and enforcement of IP rights is crucial in preserving the value and competitive advantage of the involved entities. This paper explores the legal frameworks, due diligence processes, and best practices for safeguarding IP rights in mergers and demergers. It also delves into case studies and real-world scenarios to provide a comprehensive understanding of how businesses navigate IP challenges during corporate restructuring.

Introduction

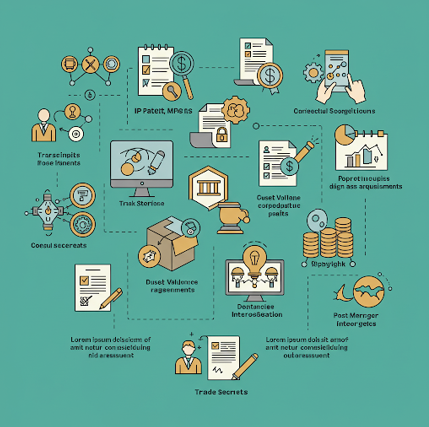

Intellectual property (IP) assets, including patents, trademarks, copyrights, and trade secrets, are among the most valuable intangible assets a company possesses. In the modern business landscape, companies rely heavily on their IP portfolios to maintain competitive advantages, foster innovation, and secure market positioning. Mergers and demergers, as strategic corporate transactions, involve the transfer, reassignment, and possible renegotiation of IP rights, making their protection a critical aspect of the process. A merger occurs when two or more companies combine to form a single entity, consolidating assets, liabilities, and business operations. A demerger, on the other hand, involves the division of a business entity into separate independent units. In both cases, the proper handling of IP rights is essential to prevent disputes, ensure compliance with legal requirements, and preserve the intrinsic value of the assets. This research paper aims to analyze the significance of IP rights in mergers and demergers, explore the legal frameworks governing their transfer, and provide best practices for safeguarding them during corporate restructuring.

Legal Framework Governing IP Rights in Mergers and Demergers

Different jurisdictions have specific laws and regulations that govern the transfer and protection of IP rights during mergers and demergers. Some of the key international and national regulations include the Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS), which provides a global framework for IP protection and enforcement, and the Paris Convention for the Protection of Industrial Property, which establishes guidelines for patent and trademark protection across signatory countries. Additionally, national intellectual property laws and corporate laws define IP ownership, licensing, and transfers within specific legal frameworks. Companies often enter into contractual agreements and licensing regulations to define the terms of IP usage and ownership. Understanding these legal frameworks is critical for ensuring compliance and preventing conflicts during corporate restructuring.

Due Diligence in IP Transactions

Conducting thorough due diligence before finalizing a merger or demerger is essential for evaluating the ownership, validity, and enforceability of IP assets. The due diligence process typically involves identifying IP assets by compiling an inventory of all registered and unregistered IP assets, including patents, trademarks, copyrights, and trade secrets. It also includes reviewing licensing agreements to determine transferability and renewal terms, assessing IP ownership to verify whether the IP assets are owned outright, co-owned, or subject to third-party claims, and reviewing any pending litigation or disputes that could affect the transaction. Additionally, evaluating IP-related risks such as infringement claims, expired patents, or pending applications is crucial. Conducting IP due diligence ensures that the acquiring or newly formed entity can legally use and protect the IP assets without future legal complications.

Challenges in IP Protection During Mergers and Demergers

Several challenges may arise when transferring or dividing IP assets during mergers and demergers. Ownership disputes due to ambiguities in IP ownership can lead to conflicts between merging or demerging entities. Licensing complications can arise when agreements contain clauses restricting transferability or requiring renegotiation. Trade secret protection is also a concern, as there is a risk of trade secrets being inadvertently disclosed or misappropriated during restructuring. Additionally, brand and trademark conflicts can impact brand integrity and the continued protection of trademarks, while regulatory compliance issues can complicate cross-border mergers and demergers due to differing jurisdictional requirements. Addressing these challenges requires a proactive approach, legal expertise, and strategic planning to minimize risks and protect IP assets effectively.

Best Practices for Ensuring IP Protection

To mitigate risks and ensure the seamless transfer or division of IP assets, companies should adopt best practices such as conducting a comprehensive IP audit to identify and address any inconsistencies. Establishing clear contractual agreements, including well-documented IP assignments, licensing terms, and confidentiality clauses, is crucial. Regulatory compliance must be ensured by adhering to jurisdiction-specific IP laws and regulations to prevent legal complications. Developing a structured post-merger/demerger IP integration plan is essential for managing, using, and enforcing IP rights after the transaction. Additionally, implementing dispute resolution mechanisms such as arbitration or mediation clauses in agreements can help resolve potential conflicts. By following these best practices, businesses can safeguard their IP assets and maximize their value during corporate restructuring.

Case Studies

Examining past mergers and demergers provides valuable insights into how companies handle IP transitions. One notable case is Google’s acquisition of Motorola Mobility in 2012, where Google acquired Motorola Mobility for $12.5 billion, primarily to obtain its extensive patent portfolio and strengthen its competitive position in the smartphone industry. This case highlights the strategic importance of IP due diligence and valuation. Another example is the Dow-DuPont merger and subsequent split between 2017 and 2019. After merging to form DowDuPont, the company later split into three independent entities, posing significant challenges in managing and reallocating IP assets among the newly formed businesses, which required meticulous planning and legal oversight. Disney’s acquisition of 21st Century Fox in 2019 further illustrates the complexities of IP transitions, as it involved the transfer of multiple IP assets, including copyrights, trademarks, and licensing agreements related to media content. Disney had to navigate complex regulatory and contractual issues to secure its ownership rights. These case studies underscore the importance of thorough IP due diligence and strategic management during corporate mergers and demergers.

Conclusion

The protection of intellectual property rights during mergers and demergers is crucial for preserving business value, ensuring compliance, and preventing legal disputes. Companies must undertake comprehensive due diligence, establish clear contractual agreements, and develop structured IP integration plans to safeguard their assets effectively. As corporate transactions become increasingly complex in a globalized economy, companies must stay proactive in managing their IP portfolios. Legal expertise, strategic planning, and adherence to best practices can help businesses navigate IP challenges and secure a strong competitive position in the market.